In the next few years, the low-power wide area network (LPWA) market will be as versatile as the Internet of Things (IoT) market it serves. Although it is more than a year away from one of the most anticipated participants in the LPWA field, industry players have competed to develop an end-user market with many differences and mostly unknown. The rise of the LPWA network is seen as a catalyst and is expected to change the nature of the embedded and machine-to-machine (M2M) market. Today's customized solutions tailored to specific applications will be replaced by a range of DIY modules and services in the future, blurring the boundaries between vendors, users and partners. The LPWA field is already competing for price before it has been approved by the market. The current dominant player in the field is Sigfox, which is said to be serving mass-produced customers at a price of about $1 per node per year. This is followed by a rapidly expanding LoRa Alliance member. Then there are almost a myriad of Sub-GHz solutions and two start-up cellular wireless technology options: LTE Cat 1 and LTE Cat M1. This puts a lot of pressure on the future of the cellular wireless field, the LTE Category M2. It is expected to quickly stand out from the 3GPP standard process, but it will not be available to major network service providers until at least 2018, in part because it requires operators to install and test a new class of application servers. . The good news is that the IoT market is vast and diverse, and it will take several years to fully mature. Many people expect that the IoT business is wide enough for everyone to eat, but it is too early to predict which technologies will become mainstream and which are niche. Module maker Electric Imp founder Hugo Fiennes is watching the rise of the low-cost cellular IoT network will rewrite the rules of the game. Nowadays, IP-based chips, boards and systems are easy to use and rich ecosystems for smart homes, moving from Bluetooth and Wi-Fi to cellular technology, making it easy to create mashups. Fiennes believes that the current M2M professional field will be replaced by the manufacturing community. At the same time, cellular IoT will enable Web 2.0 mashup application programming interfaces (APIs) to create more new services. Young Sohn, Samsung's chief strategist, shared a similar view of IoT in a recent presentation at the Imec Technology Forum. For example, he said that a trendy partner has set up Ring.com to connect video-enabled doorbells to smart phones. "What he did was find three people and put things together - this is the power of intelligence, networking devices and the cloud," Sohn said. “Building products is easier than ever,†he said, pointing out that Instagram was built by three engineers in six weeks, while Microsoft’s Windows upgrade required 300 engineers to spend two years. Samsung, its rival Intel (Intel) and any chip supplier with a microcontroller product line are preparing to launch this low-power module supported by interface devices and services to meet this wave of IoT opportunities. Cellular module manufacturers are hoping this vision will be realized as soon as possible, making its relatively expensive and power-hungry M2M product line into the larger IoT market. The data price is the next unknown The 10Mbit/s LTE Cat 1 module is now attracting existing M2M users who want to upgrade their 2G and 3G networks. They are worried that 2G and 3G networks will soon be out of service. As the 1Mbit Cat M standard is expected to be launched next year, "we have seen new markets and today's cellular markets that cannot be met; because the existing technology does not provide long battery life and price," NimbeLink CEO Scott Schwalbe said NimbeLink is a small but growing cellular modem provider. Today's M2M users range from ATM machines, vending machines, electronic billboards, point-of-sale terminals to programmable logic controllers, and most of them operate on 2G networks. The current Cat 1 product opens up potential opportunities for remote monitoring of oil and gas fields and farms, but the cost and power consumption are usually the same as for 2G products, Schwalbe said. With Cat M, customers will “no longer be technology companies, but manufacturers such as chemical companies, non-tech products companies, etc. who want to monitor or manage their products and processes,†he said. "If the price of the edge sensor plus the battery is $50, the entire market for embedded remote monitoring will be launched," he added. Price and power consumption continue to bottom out Whether mobile operators will reduce the price of data to the ultra-low level required to attract this new application area is still skeptical. “I agree with this view. Operators are facing the challenge of choosing the right price point, especially whether the price adjustments for Cat M1 and M2 will remain to be seen,†said Axel Hansmann, vice president of M2M product line and strategy at module manufacturer Gemalto. "The challenge is: unless you have a lot of connections... it's hard to make a profit," he said. Fiennes believes that operators will understand the opportunity of IoT and will set the price low enough to start the market. Amazon's Kindle has guided the way. He added that without the need to support traditional 2G/3G networks, the chipset can be made simpler, and everyone no longer has to pay 2G/3G to Qualcomm and other companies. The patent fee for the network. Operators For operators, CAT1 and M1 are software upgrades to their existing networks. But M2 will need them to deploy a new set of application servers defined by 3GPP to handle non-IP traffic. Additional testing and cost means that few operators will start the M2 network by 2018. China will be an exception. Considering spectrum availability, China is expected to skip M1 directly to M2. Another focus on the cellular technology roadmap is that some operators are expected to deploy new low-cost 3G versions in Europe and other areas lacking LTE – the so-called extended coverage GSM (EC-GSM); it will work with the original 2G and 3G networks compete, especially in Europe, where various cellular technologies are intertwined. For example, some operators in the Nordic region have indicated that they will shut down 3G, but retain 2G for IoT. In the US, AT&T announced that it will shut down its 2G network in 2017, forcing users to switch to more efficient LTE networks. AT&T has launched the Cat 1 service and plans to test CatM1 by the end of this year and M1 service next year. But so far, AT&T has no public timetable for M2 services or even trials. At present, AT&T has the largest share of M2M customers and industrial IoT users with more than 28 million. Cameron Coursey, vice president of product development at AT&T's IoT, said its users range from low-bandwidth applications such as asset tracking to surveillance video cameras and car networking. There are also service providers like Orange that may be used for every technology. Arnaud Vamparys, Orange's vice president of wireless access networks, pointed out that in Europe and Africa, more than 9 million M2M subscriber services have been in operation. 2G and EC-GSM offer the ideal national coverage, Vamparys said. With CatM1 already tested in the lab, LTE offers more options. By mid-2016, Orange will deploy a nationwide LoRa network covering 1,200 cities in its hometown of France. Currently, about half of cellular IoT users still use 2G networks. Schwalbe pointed out that the demand for 3G is still low, and some users even need LTE Cat 3 or 4 to support applications, such as video streaming service stations. NimbeLink is now busy helping more than 50 customers design Cat 1 hardware. Which of these many new options will gain momentum? What applications are available for? And when do you take off? Schwalbe believes that all of this remains to be seen.

Solar energy system, off gird pv system, grid pv system, solar power system, Solar Panel system, on grid solar system, grid tied solar system,20kw solar system

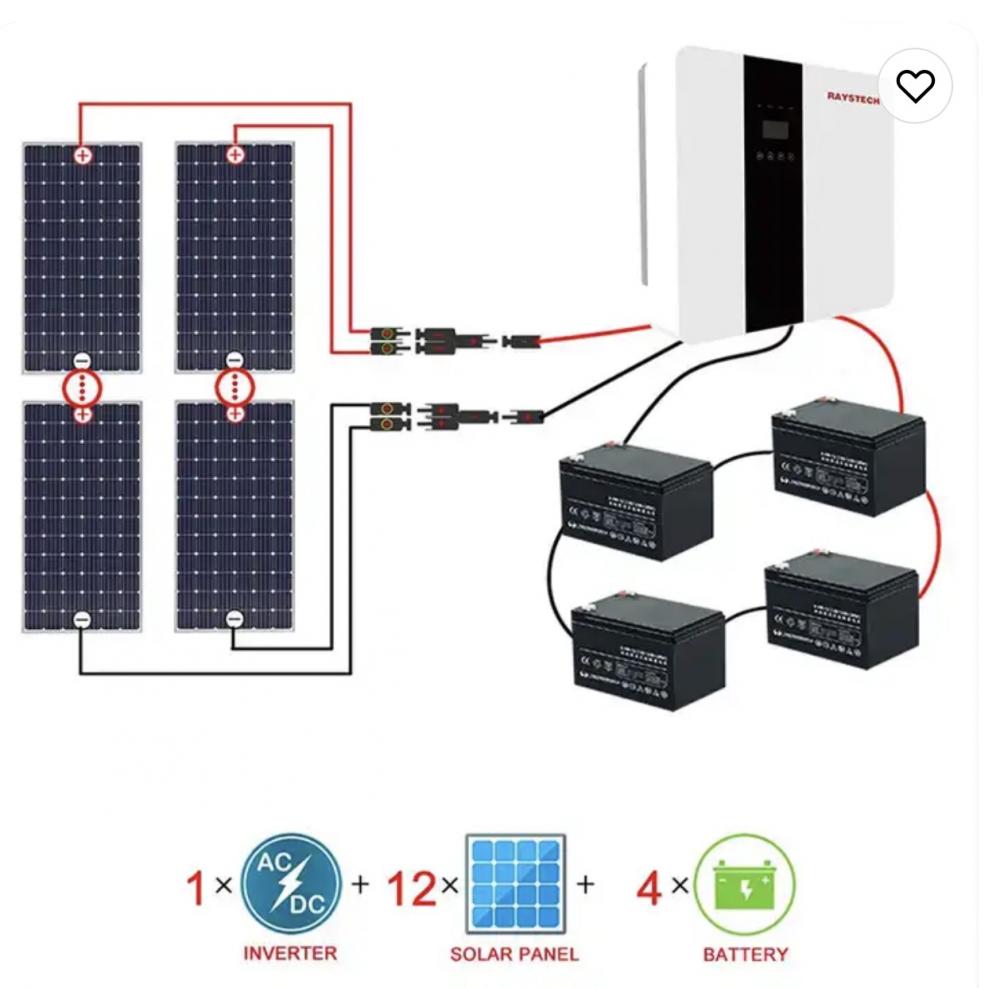

Solar energy system include Solar photovoltaic system: 1. Off grid photovoltaic system mainly consists of solar modules, controllers, and batteries. To supply power to AC loads, it is also necessary to configure an AC inverter. 2. Grid connected photovoltaic power generation system. 3. Distributed photovoltaic power generation system. Distributed power generation or distributed energy supply.

Solar Engergy System,Gird Solar Power System,Pv System For Carport,Energy System Off Grid Solar System PLIER(Suzhou) Photovoltaic Technology Co., Ltd. , https://www.pliersolar.com

solar cell type

mono crystalline, half cut cell

solar energy pv system include

on grid system, off grid system, hybrid system

solar configuration

solar panel, inverter, battery, bracket cabels, mc4 connector

Product details and pic