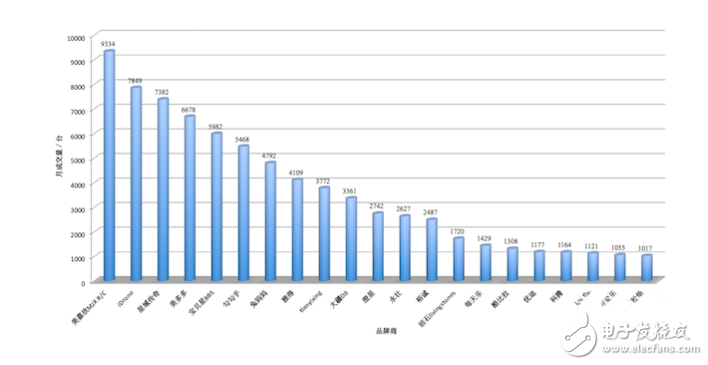

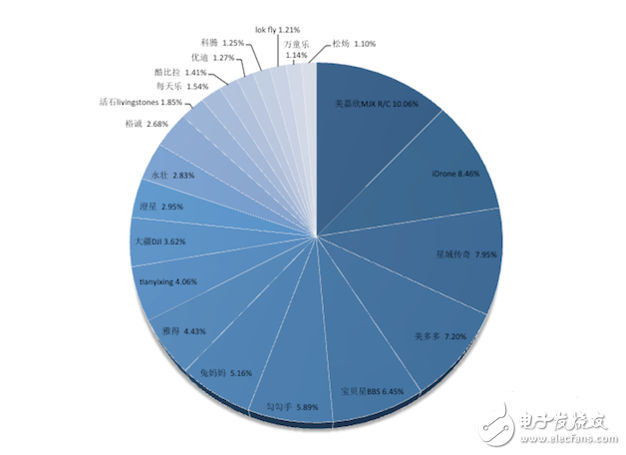

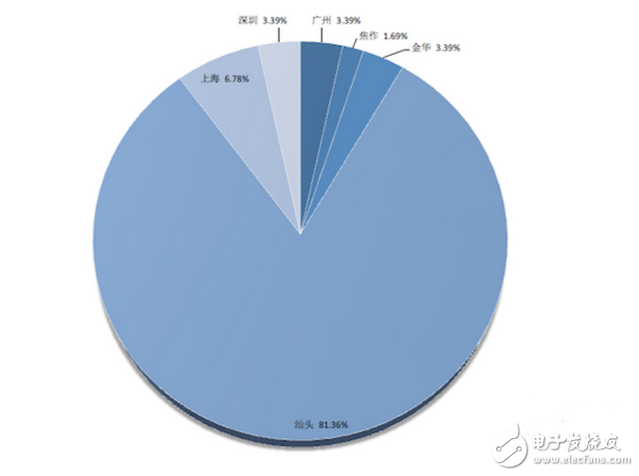

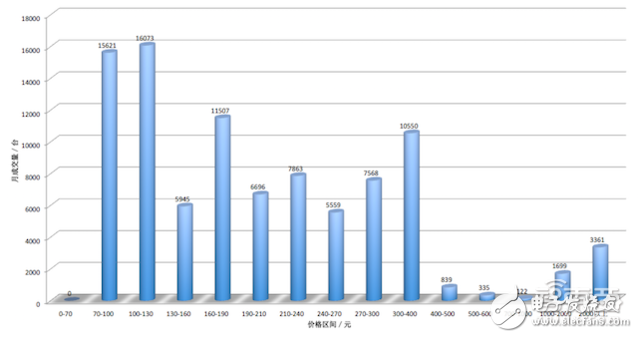

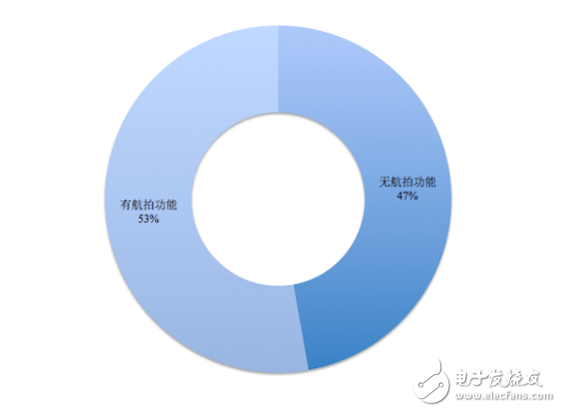

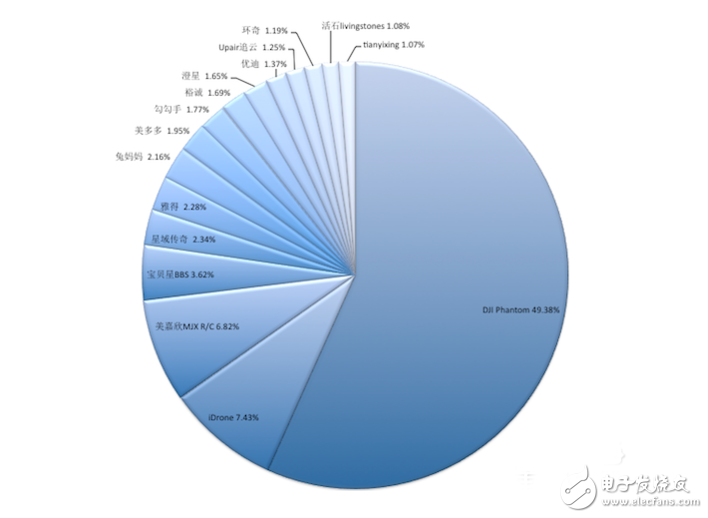

When the civilian quad-rotor UAV companies such as Dajiang and Parrot seized the mainstream market, they earned a lot of money, and dozens of startup companies such as Territory, Yihang, Star Map, Feibao, Zero Intelligence, and Euler Space. When start-ups try their best to win a share of the market, the real money-making players may not be them. The author conducted a variety of research, analysis and interviews for this purpose. Through the mainstream online platform sales tracking in the past month, exchanges with several drone startup companies, and feedback from comprehensive offline channels. We have unexpectedly discovered that behind the domestic sales of nearly three billion yuan of UAVs, in addition to a group of veterans such as Dajiang, there is another underground river and lake... The traditional toy manufacturers from the tides Behind the winners, they created even more amazing sales with low prices, low cost, and simple features. At the same time, we also noticed that the performance of the products of the startups is still weak. The most popular time for the drone entrepreneurial boom was in 2015, and this year there is a clear slowdown. After a lapse of one year, is the focus of capital shifting, the rookies gradually decreasing, and the drone of the drone has passed away? First, the main force that sells nearly 100,000 units a month is actually them? The author tracked the sales of drones (including toy UAVs) in Taobao (including Tmall) and Jingdong and other domestic mainstream online platforms in July this year, covering a total of more than 120 home appliance stores (screening standard: monthly sales) More than 100 sets), more than 60 drone brand manufacturers sorted into a table for analysis. Using the latest July online data as an important guide and reference, through chart analysis and forecasting the overall sales of domestic drone online channels, including: 1) Sales and sales of each drone brand market; 2) Distribution trend of drone brand regions; 3) The trend of price range distribution of unmanned aerial vehicles; 4) The distribution trend of the aerial photography function of the drone; 5) Sales volume of each brand market. 1) By counting the sales of Taobao (including Tmall) and JD.com, the overall sales volume (unit: Taiwan) of each brand is ranked. Figure 1.1: UAV brand market sales ranking As can be seen from the sales ranking histogram, the top five drone brands such as MJX R/C, iDrone, and Baby Star BBS are all backgrounds of toy factories. The average monthly sales volume is around 7,000 units, which may be In the mainstream technology circle, these brand names are extremely strange. The top sales of the MJX R/C at the top of the list reached 9,334 units. The professional-grade drone brand DJIX is only ranked 10th with a monthly sales of 3,361 units. Figure 1.2: Sales share of drone brand market Through the summary of the online sales of more than 100 stores on the e-commerce platform, the total monthly sales of drones on the online platform was 92,806. Based on this, the sales volume of each brand was obtained. At the same time, we can also see that this initial statistical online retail channel has a scale of 100,000 units, and the market is very large. The share ratio is similar to the sales ranking. It can be seen that the top-ranked MJX R/C market accounts for nearly 10% of the market, accounting for about 40% (40.11%) of the top five brands. 2) Although I have heard about the development of the industrial chain of Shenzhen and its surrounding drones, it is still quite surprising after sorting out real-time data. Among the more than 60 drone brands with monthly sales exceeding 100 units, 88.14% concentrated on Guangdong Province, headed by Shantou, Shenzhen and Guangzhou, with Shantou manufacturers accounting for 81.36%. The reason behind this will be answered later. Figure 2: Distribution of drone brand regions 3) By integrating the sales data of the online e-commerce platform, it can be found that the sales price of the drone category is relatively large, ranging from 70 yuan to 9999 yuan. Among them, the sales volume of 70-100, 100-130, 160-190, and 300-400 is the most significant, with monthly sales reaching more than 10,000 units; the highest sales in the 100-130 yuan interval reached 16073. station. The UAV category in the interval of 2000 to 9999 yuan is mainly based on the Phantom series of DJI Innovation DJI, and the overall sales volume reached 3,361 units. It is a pity that other drone brands with more than 2000 have not reached the sales level of over 100 in the period of the author's statistics. This reflects the embarrassment faced by the mid-end price drone brand online platform. Figure 3: Online price range distribution of drones 4) To a large extent, various additional functions such as aerial photography, data transmission, and intelligent flight of the drone determine the price positioning of the product. Many industry insiders pointed out that whether it has the above functions is an important separation standard for UAVs and aircraft models, toys and other types of UAV products. However, with the further maturity of the market and consumer demand, the author found that more and more toy drone manufacturers have also introduced intelligent functions such as photographing, camera, image transmission, real-time monitoring, hovering, follow-up, etc. The price of the functional model is slightly higher than that of the ordinary model, but it is still generally below 2,000 yuan. Figure 4: Distribution trend of drone aerial photography function 5) The previous article has been thoroughly compared and analyzed for sales, but from the perspective of enterprises and businesses, sales is an important indicator for judging whether it can be profitable. After combining sales and unit price factors, we can see that DJI's innovative DJI is still in an absolute leading position with 49.38%. It can be said that Dajiang has indeed earned most of its profits. The market of other brands is relatively balanced, and there are no brands with a single share of more than 10%. Figure 5: Sales of drone brand market share We can follow customers' drawings or design to make Customized wire harness for various industries: game machine, ATM, POS machine, etc.

Customized wire assembly with AVL components from original manufactures. Also harness with local equivalent componets are workable with short L/T and competitive price, also flexible MOQ.

Related Products:cigarrete charging cable,custom audio cables,fiber optic cable,cigarrete lighter cable.

Cigarrete Lighter Cable,Custom Audio Cables,Fiber Optic Cable,High Quality Electrical Wire Harness,Automotive Wiring Harness,Coiled Cable,Wiring Assemblies,Fuse Holder,Auto Plug Cable,Cigarrete Charging Cable ETOP WIREHARNESS LIMITED , http://www.oemwireharness.com